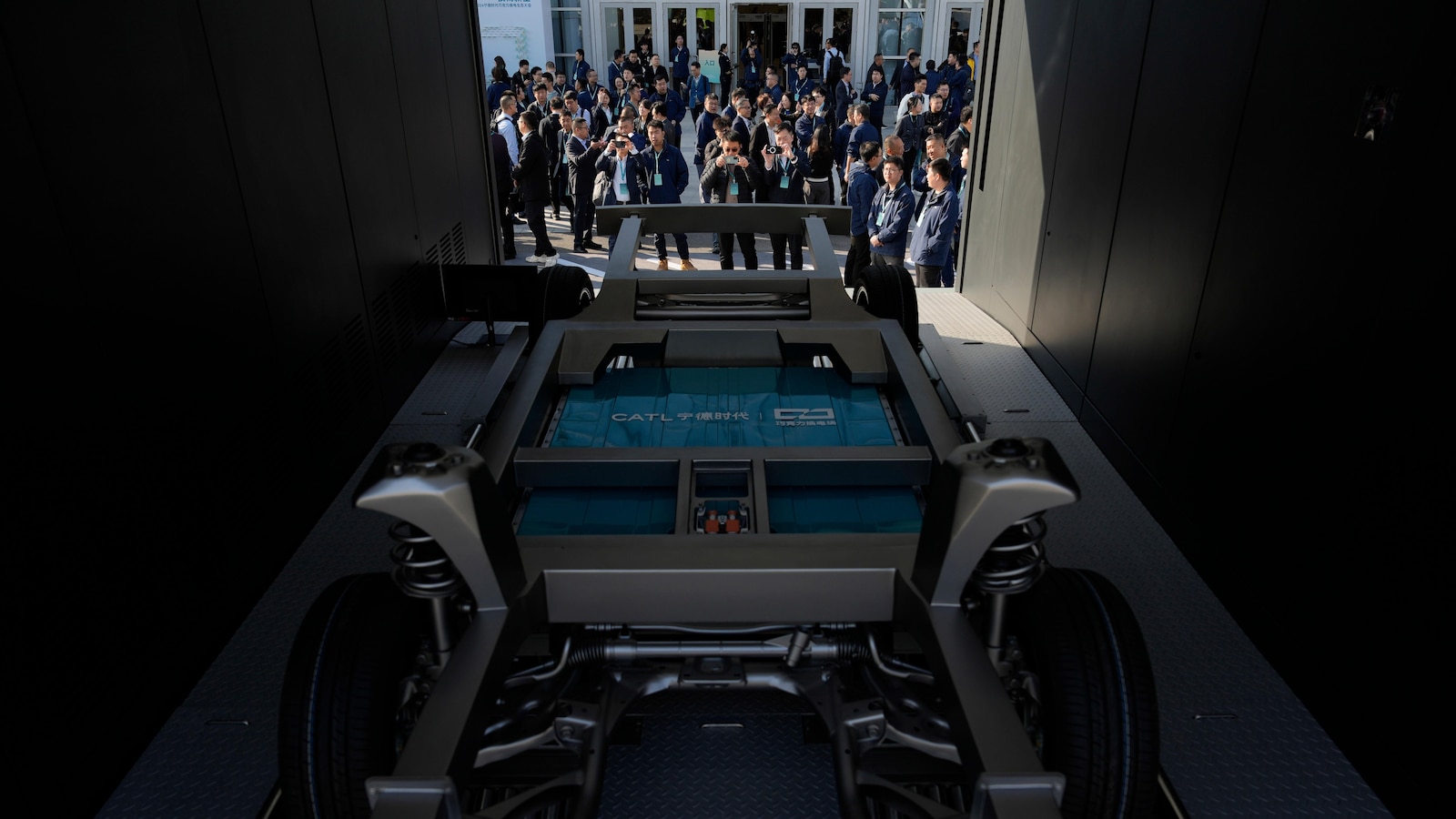

Detroit — China will soon see a massive expansion of electric vehicle battery swapping, as global battery maker CATL said Wednesday it is investing heavily in stations there next year.

Battery swapping is not new — but it’s had a challenging journey. Adoption of electric vehicles has varied in regions across the globe over the past several years, and that doesn’t always bode well for building new infrastructure.

While the technology could do well in China, it’s uncertain whether it could work in other countries.

Battery swapping allows EV drivers to pull into a station on a low battery and receive a swapped, fully-charged battery within minutes.

An EV has to be equipped with the right technology to receive a swap — and not many models around the world currently have it. Automakers have to buy into the idea, and EV adoption among consumers also has to grow, so that investing in new infrastructure seems worthwhile. Consumers also have to be comfortable not owning their battery.

China is much further along in adopting EVs than other countries.

Not only is it the world’s largest auto market, but in July, the country hit a milestone with 50% of new sales electric — and it accounts for most of this year’s global EV sales.

China supports EV growth through government subsidies and mandates. So it makes more sense for companies to invest in unique EV infrastructure there because that’s more likely to be needed.

The most notable example might be Israeli startup Better Place, which tried its hand at swapping in 2007.

But the company shut down a few years later after investing a lot of money and coming up against roadblocks with logistics. EV adoption was especially low at the time.

Startup Ample, for example, has a modular battery swapping station that it says can complete a swap in 5 minutes. That’s important as charging time remains a point of concern for prospective EV buyers. Even the fastest fast chargers could take at least 15 minutes for a decent charge.

But in the U.S., pure EVs only accounted for 8% of new vehicle sales as of November.

Meanwhile Nio, a rival Chinese EV brand, has about 60 swap stations in northern Europe, and the EV adoption is higher there than the U.S., but the same challenges remain.

Different automakers put different batteries in their various EV models, so a station would need all of those available if the industry didn’t agree to a standardized battery, and not all of those models are out yet in volume. This is something that really needs scale.

Swapping could help with EV cost — currently a barrier to adoption for many — because a driver wouldn’t necessarily own the most expensive part of an EV: the battery.

Greg Less, director of the University of Michigan Battery Lab, said with proper framing and education, people might like the idea of battery swapping. To him, it’s not unlike buying a propane-fueled grill and purchasing a refilled tank every so often. But it would require a rethinking of car ownership.

“Where I could see it working is if we went entirely away from vehicle ownership and we went to a use-on-demand model,” Less added. “I don’t think we’re there yet.”

Battery swapping might make most sense for ride-sharing or other fleet vehicles.

Drivers of buses, taxis, Uber or Lyft vehicles want to spend as much time on the road as possible, transporting customers and making money. If battery swapping can shorten the time needed to charge EVs, that makes driving one less disruptive to their business.

___

Alexa St. John is an Associated Press climate solutions reporter. Follow her on X: @alexa_stjohn. Reach her at ast.john@ap.org.

___

Read more of AP’s climate coverage at http://www.apnews.com/climate-and-environment

___

The Associated Press’ climate and environmental coverage receives financial support from multiple private foundations. AP is solely responsible for all content. Find AP’s standards for working with philanthropies, a list of supporters and funded coverage areas at AP.org.