WASHINGTON — President Donald Trump on Tuesday talked up a joint venture investing up to $500 billion for infrastructure tied to artificial intelligence by a new partnership formed by OpenAI, Oracle and SoftBank.

The new entity, Stargate, will start building out data centers and the electricity generation needed for the further development of the fast-evolving AI in Texas, according to the White House. The initial investment is expected to be $100 billion and could reach five times that sum.

“It’s big money and high quality people,” said Trump, adding that it’s “a resounding declaration of confidence in America’s potential” under his new administration.

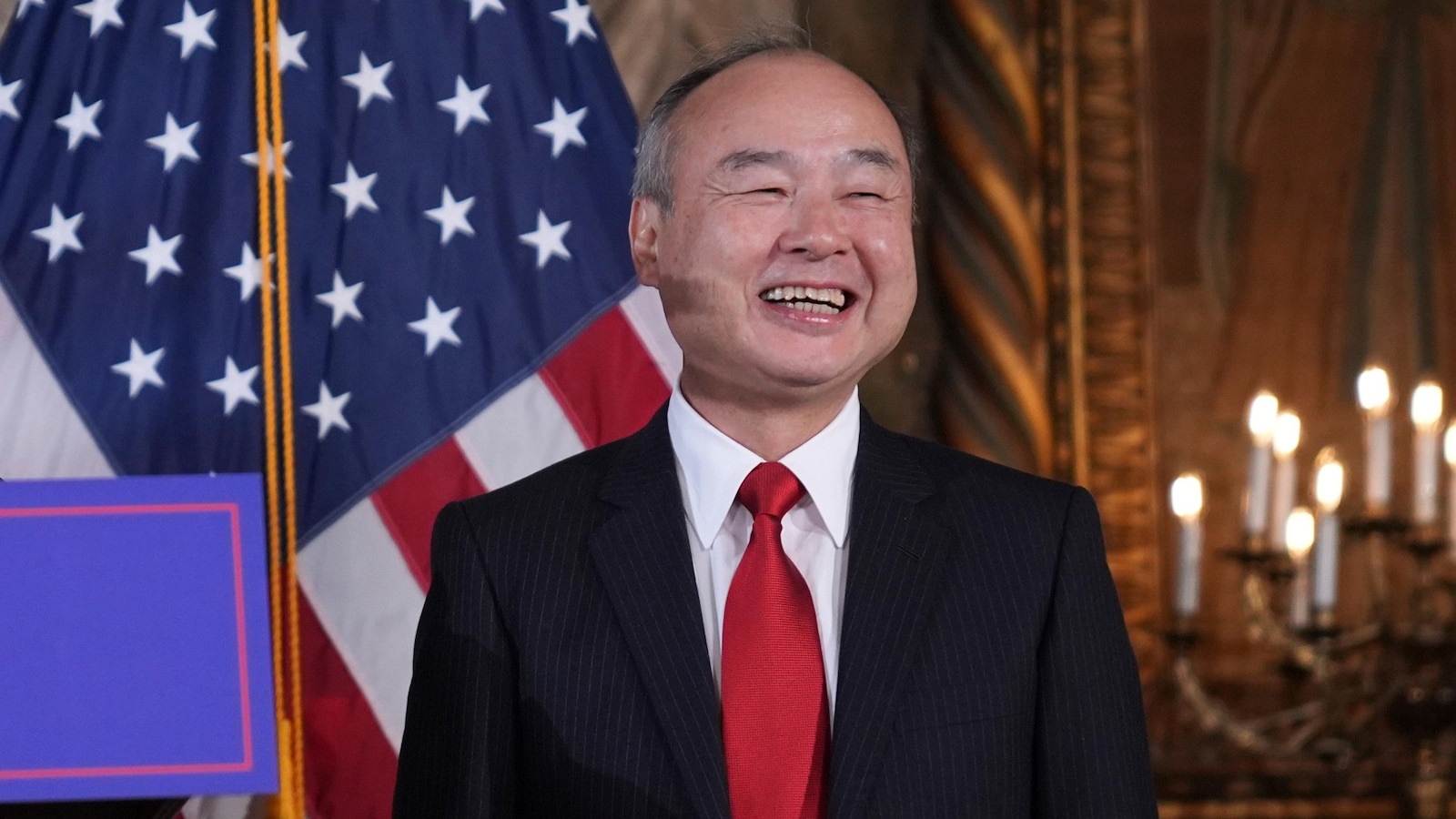

Joining Trump fresh off his inauguration at the White House were Masayoshi Son of SoftBank, Sam Altman of OpenAI and Larry Ellison of Oracle. All three credited Trump for helping to make the project possible, even though building has already started and the project goes back to 2024.

“This will be the most important project of this era,” said Altman, CEO of OpenAI.

Ellison noted that the data centers are already under construction with 10 being built so far. The chairman of Oracle suggested that the project was also tied to digital health records and would make it easier to treat diseases such as cancer by possibly developing a customized vaccine.

“This is the beginning of golden age,” said Son, referencing Trump’s statement that the U.S. would be in a “golden age” with him back in the White House.

Son, a billionaire based in Japan, already committed in December to invest $100 billion in U.S. projects over the next four years. He previously committed to $50 billion in new investments ahead of Trump’s first term, which included a large stake in the troubled office-sharing company WeWork.

While Trump has seized on similar announcements to show that his presidency is boosting the economy, there were already expectations of a massive buildout in data centers and electricity plants needed for the development of AI, which holds the promise of increasing productivity by automating work but also the risk of displacing jobs if poorly implemented.

The initial plans for Stargate go back to the Biden administration. Tech news outlet The Information first reported on the project in March 2024. OpenAI has long relied on Microsoft data centers to build its AI systems, but it has increasingly signaled an interest in building its own data centers.

OpenAI wrote in a letter to the Biden administration’s Commerce Department last fall that planning and permitting for such projects “can be lengthy and complex, particularly for energy infrastructure.”

Other partners in the project include Microsoft, investor MGX and the chipmakers Arm and NVIDIA, according to separate statements by Oracle and OpenAI.

The push to build data centers predates Trump’s presidency. Last October, the financial company Blackstone estimated that the U.S. would see $1 trillion invested in data centers over five years, with another $1 trillion being committed internationally.

Those estimates for investments suggest that much of the new capital will go through Stargate as OpenAI has established itself as a sector leader with the 2022 launch of its ChatGPT, a chatbot that captivated the public imagination with its ability to answer complex questions and perform basic business tasks.

The White House has put an emphasis on making it easier to build out new electricity generation in anticipation of AI’s expansion, knowing that the United States is in a competitive race against China to develop a technology increasingly being adopted by businesses.

Still, the regulatory outlook for AI remains somewhat uncertain as Trump on Monday overturned the 2023 order signed by then-President Joe Biden to create safety standards and watermarking of AI-generated content, among other goals, in hopes of putting guardrails on the technology’s possible risks to national security and economic well-being.

CBS News first reported that Trump would be announcing the AI investment.

Trump supporter Elon Musk, worth more than $400 billion, was an early investor in OpenAI but has since challenged its move to for-profit status and has started his own AI company, xAI. Musk is also in charge of the “Department of Government Efficiency” created formally on Monday by Trump with the goal of reducing government spending.

Trump previously in January announced a $20 billion investment by DAMAC Properties in the United Arab Emirates to build data centers tied to AI.

___

AP reporter Matt O’Brien contributed to this report from Providence, Rhode Island.