Find out which countries prove to be prime residential hotspots.

Knight Frank’s recent report has identified Asia-Pacific as a premier lifestyle and investment destination, with Singapore standing out for individuals considering relocation.

In its latest report, “Quality Life-ing: Mapping Prime Residential Hotspots”, Knight Frank evaluates 15 prominent markets based on five leading indicators: Economy, Human Capital, Quality of Life, Environment, and Infrastructure and mobility.

Singapore, Australia, Japan and Malaysia lead the rankings as Asia-Pacific’s leading lifestyle and investment hotspots.

Here’s more from Knight Frank:

Singapore: Recognised for its stability and development, Singapore emerged the top destination as it ranks among the top five in all indicators. Its robust economy, marked by political stability and a skilled workforce, makes it an attractive destination for businesses and individuals.

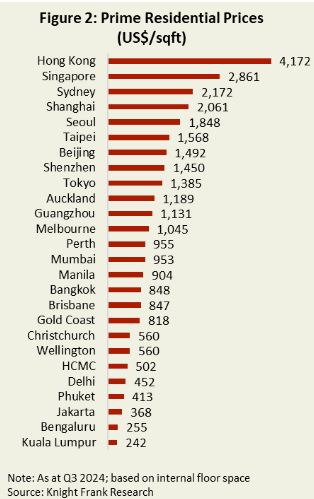

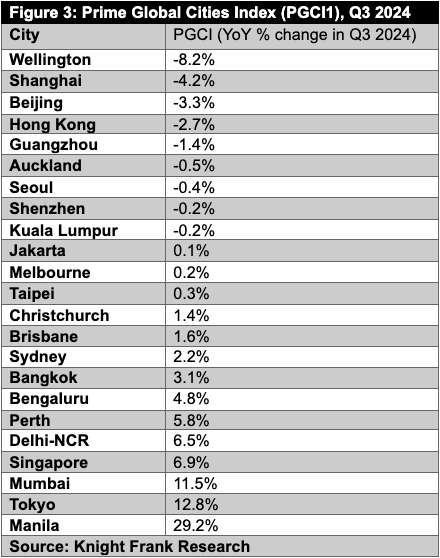

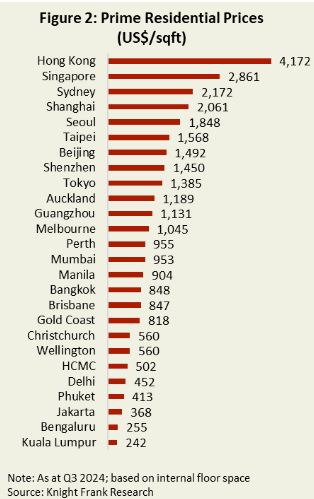

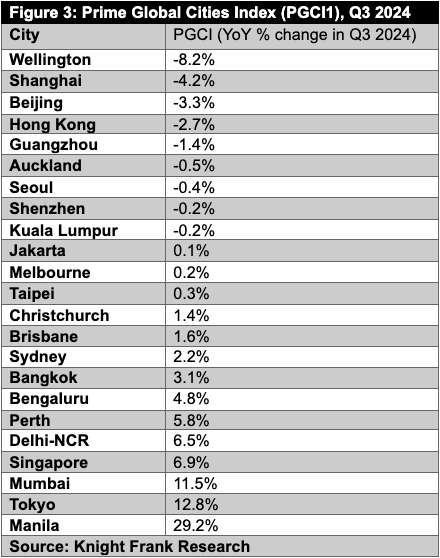

In Q3 2024, prime residential prices rose 6.9% year-on-year, making it the second most expensive market in APAC (Figure 2, at 2,861 US$ per square feet (psf)), 31% cheaper than Hong Kong (US$4,172 psf), but still ahead of Sydney (US$2,172 psf), Shanghai (US$2,061 psf) and Seoul (US$1,848 psf). The city-state’s economic fundamentals remain strong, with low unemployment and projected GDP growth of 1-3% for 2024. Additionally, the Family Office sector has surged from 400 in 2020 to 1,650 by August 2024, reinforcing its status as a global wealth management hub.

Australia: Australia is the second most desirable location for investments and relocations, as it came in top 5 for four out of the five indicators in our study. In Q3 2024, major cities like Sydney experienced a 2.2% year-on-year price increase, supported by cash buyers and limited property supply. Despite rising interest rates, Australian cities continue to show positive price trends.

The country’s diverse landscapes cater to various lifestyles, with cities like Perth seeing significant population growth of 3.6% in FY2023. Sydney continues to be the financial capital, home to over a third of Australia’s ultra-high-net-worth individuals, and Melbourne ranks highly for quality of life, excelling in healthcare and education retaining the top spot in Australia as the EIU’s most liveable city in 2024. Overall, Australia’s attractive residential market and enviable lifestyle continue to draw investors, expatriates, and international students from around the globe.

Japan: Japan excels in Quality of Life and Infrastructure & Mobility aspects, boasting a high life expectancy and sophisticated transportation network. With modest economic growth projected at 0.9% for 2024, rising wages are expected to enhance consumer spending. The Tokyo residential market has shown resilience, with prices increasing over 20% since Q1 2022 and an annual rise of 12.8% noted in Q3 2024 (for the full breakdown, please click here), making it the second best-performing market in Asia-Pacific.

This growth is fuelled by high demand for luxury condominiums amid limited supply. Additionally, Japan’s stock market reached an all-time high this year, attracting substantial foreign investment as Tokyo’s population continues to grow with an influx of foreign residents and investors.

Malaysia: Malaysia, emerging as a hub for technological innovation, is attracting major tech companies like Oracle and Microsoft due to its favourable business climate. The country’s prime residential market is poised for stability and gradual growth, reflecting the broader resilience of the Asia-Pacific region’s real estate sector. Kuala Lumpur also remains the most affordable market in APAC, with prime residential prices at US$242 psf, making it a top choice for expatriate relocations.

Despite facing challenges from rising interest rates, the Malaysian property market has shown signs of recovery, with significant transactions recorded in early 2024. The government’s initiatives, such as maintaining interest rates at 3% and offering stamp duty exemptions for first-time homebuyers, are expected to stimulate demand.

Kuala Lumpur is a focal point for this growth, where new residential projects are catering to evolving buyer preferences, particularly among single-family households seeking lifestyle-oriented developments. Additionally, the appeal of Malaysia’s real estate is enhanced by its strategic location and cultural richness, making it an attractive option for both local and foreign investors looking for quality residential opportunities.

Other emerging markets in Asia-Pacific, such as the Philippines, India, Vietnam, Thailand, and Cambodia, are experiencing significant growth. In the Philippines, Manila’s prime residential prices continue to thrive, with remarkable growth of 4.6% over the past three months and an annual increase of 29.2%, driven by strong economic growth and rising consumer confidence according to Knight Frank’s Prime Global Cities Index Q3 2024.

India is projected to lead with a 7.0% GDP growth rate in 2024, driven by a booming tech sector expected to contribute US$350 billion to the GDP by 2026. Momentum in the residential market in India has significantly increased in 2024, with Q3 recording the highest quarterly sales of 87,108 units, representing a 5% year-over-year (YoY) increase and a 9% rise compared to year-to-date figures, particularly in the luxury segment.

Vietnam follows closely with a GDP growth forecast of 6.1%, bolstered by its favourable manufacturing landscape and the ‘China+1’ strategy, attracting expatriates and investors alike. The average selling price for high-end apartments in Ho Chi Minh City and Hanoi ranges from US$5,400 to US$15,000 psm, aligning with prices in developed global markets, appealing to wealthy individuals due to competitive pricing and strong potential for capital appreciation.

In Thailand, Bangkok’s prime real estate segment has demonstrated remarkable resilience, achieving a sales rate of over 80% of total supply despite challenges like limited land availability and rising costs in the central business district and along the Chao Phraya riverside. The demand for high-quality developments in these sought-after locations remains strong.

Finally, Cambodia’s urbanisation is set to accelerate, with the population living in urban areas projected to rise from 24.2% currently to 30.6% by 2030 and further to 41.1% by 2050. This increasing urbanization, combined with one of the youngest demographics in the region, is driving a growing demand for affordable housing, particularly in Phnom Penh.

The Asia-Pacific residential market is poised to remain attractive to HNWIs, expatriates, and investors due to its strong price resilience amid global economic uncertainties, with safe-haven markets like Singapore, Australia, and Japan leading the way. The region’s sustained economic growth and rising affluence are expected to drive stable price growth and returns, particularly as 19 megacities are projected to emerge by 2030, intensifying housing demand.

Additionally, the middle-class population in Asia-Pacific is anticipated to reach 1.7 billion by 2030, prompting a significant rise in demand for affordable housing, especially in emerging markets like Vietnam and Indonesia. Furthermore, there is a noticeable shift toward branded residences in the prime market especially in markets such as Australia, India, and Thailand, appealing to both local and international investors who value luxury living combined with high-end services on top of secure investments.