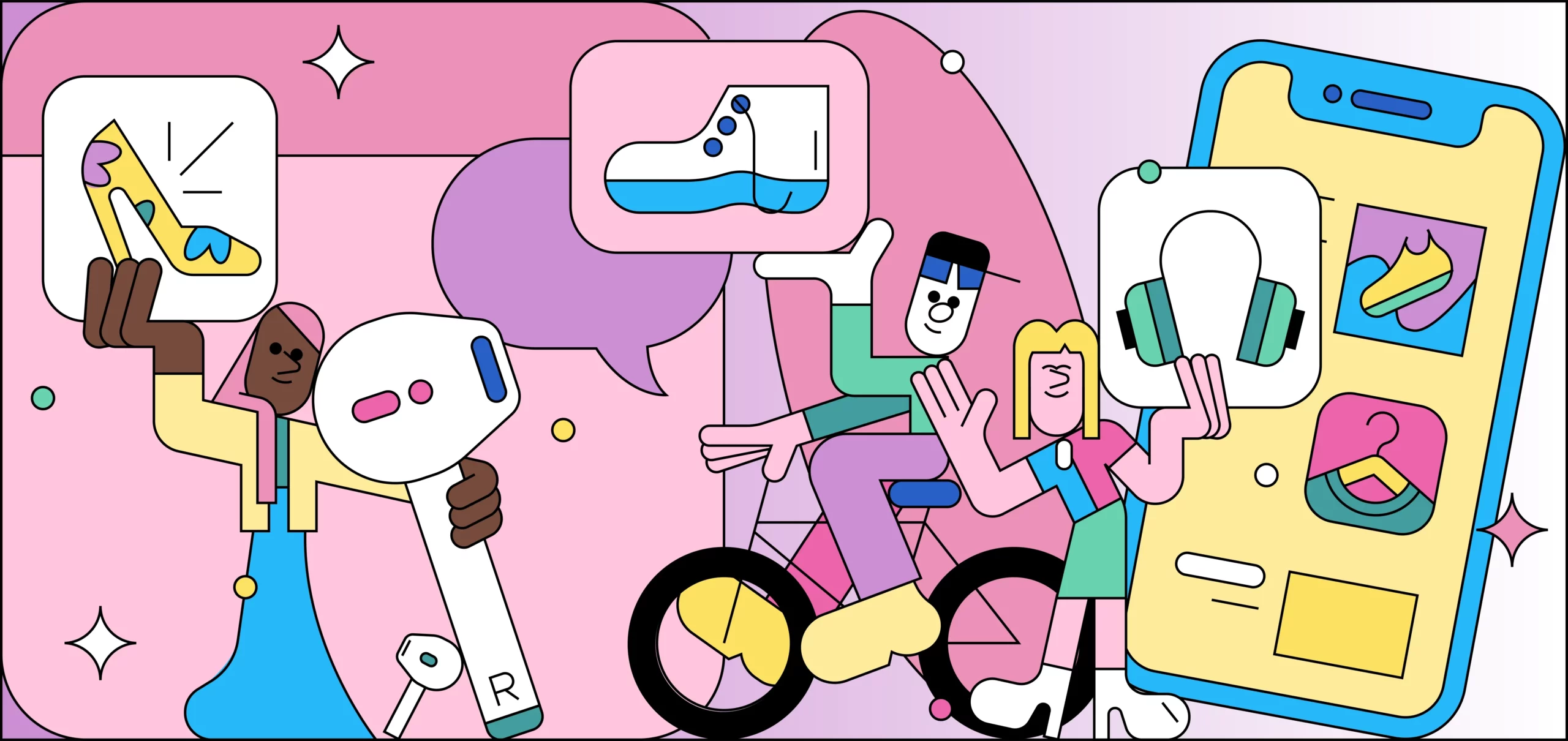

These tech-savvy generations with their smartphones glued to their hands, are setting the pace for everything from e-commerce explosions to eco-friendly revolutions—“Buy Now, Pay Later” options or turning their ethical compass into spending power.

Hence, Millennials and Gen Z are rewriting the rules of consumption and they’re doing it with style.

Millennials And Gen Z Changing Global Consumption Patterns

Millennials those who are born between 1981-1996 and Generation Z, born between 1997-2012 are reshaping global consumption patterns in many ways than one. Their preferences, shaped by technology, values around sustainability, and a need for personalization, are driving key changes across industries.

So what are the key factors behind these shifts, supported by relevant data, as we examine their impact on businesses and markets?

1. Digital-Native Behaviors Giving Rise To E-Commerce and Social Media Shopping

Since, Millennials and Gen Z have grown up with the internet, smartphones, and social media, it has impacted and influenced their shopping behaviours in more ways than one.

As a result, E-commerce has experienced rapid growth due to these tech-savvy generations.

According to eMarketer, global e-commerce sales reached $5.2 trillion in 2021, and a significant portion of this demand comes from Millennials and Gen Z consumers.

Likewise, a Shopify study revealed that 67% of Millennials and 63% of Gen Z prefer shopping online over physical stores. Moreover, social media platforms like Instagram, TikTok, and YouTube have become integral to their shopping habits.

According to McKinsey, Gen Z, in particular, is seen engaging with influencers and digital content to discover new products, with 54% of Gen Z using social media for product research.

These platforms have blurred the lines between content consumption and e-commerce as they provide tailored shopping experiences and direct links to purchase.

2. Value-Driven Consumption Aiming At Sustainability, Ethical Choices

Notably, both Millennials and Gen Z place significant importance on environmental sustainability and ethical practices; hence, they are more likely to support brands that align with their values, such as reducing carbon footprints, using sustainable materials, and promoting social causes.

A 2022 study by First Insight showed that 73% of Gen Z and 62% of Millennials are willing to pay more for sustainable products, emphasising their priority on ethical consumption.

This generational shift has accelerated the growth of sustainable and eco-friendly industries and according to Statista the global market for sustainable fashion is projected to have reached $8.25 billion in 2023.

Additionally, the rise of secondhand marketplaces like ThredUp and Depop, popular with younger consumers, demonstrates their commitment to reducing waste.

To give it some perspective, ThredUp’s 2022 Resale Report found that the secondhand clothing market grew 24 times faster than traditional retail in 2021, driven by Millennials and Gen Z’s desire to extend product life cycles.

3. Experience Over Material Goods

It also has been noted that it is experiences, rather than material possessions, that hold more appeal for these younger generations.

According to a 2021 Eventbrite survey, 78% of Millennials prefer to spend money on experiences over goods, such as travel, dining, and entertainment.

Hence, the alignment has created growth in industries related to leisure, tourism, and digital experiences (such as video games and virtual events).

Gen Z, in particular, has grown up with access to technology that facilitates experiences through virtual means.

In the gaming sector, Gen Z is the primary demographic, accounting for 40% of global gaming revenue. Similarly, demand for streaming services like Netflix, Disney+, and Spotify has surged, with these generations preferring on-demand, personalized content.

The global streaming market, which reached $100 billion in 2021, is largely driven by this shift in preferences.

4. Financial Responsibility and “Buy Now, Pay Later” Services

Surprisingly, Millennials and Gen Z are known for their cautious approach to financial management, perhaps shaped by the financial crises, the rise in student loan debt, and economic uncertainty.

Hence, traditional credit cards are often avoided in favour of more flexible financing options. The “Buy Now, Pay Later” (BNPL) model has surged in popularity, with companies like Klarna, Afterpay, and Affirm catering to this demand.

According to Worldpay’s 2022 Global Payments Report, BNPL accounted for 2.1% of global e-commerce transactions in 2021, and this figure is expected to rise as younger consumers favour short-term instalment plans.

5. Health and Wellness Focus

Both Millennials and Gen Z are also driving demand in the health and wellness industry. Their top priority is mental and physical well-being, resulting in significant growth in fitness products, organic foods, and mental health apps.

According to the Global Wellness Institute, the global wellness market was valued at $4.4 trillion in 2020, with Millennials and Gen Z accounting for much of this demand.

For example, plant-based diets are particularly popular among these groups, with 65% of Gen Z and 79% of Millennials reporting they are willing to incorporate more plant-based foods into their diets, according to a 2022 study by Bloomberg Intelligence.

This shift has fueled the rise of companies like Beyond Meat and Impossible Foods, and it is expected that the plant-based food market will grow to $162 billion by 2030.

In India, CLSA’s Report

Urban Indians are ditching old-school retail and FMCG buys for the thrill of experiences, travel, and endless food deliveries, according to CLSA’s latest report.

Traditional consumption? That’s so yesterday.

Take Sunday, for instance: more than 1 lakh people were left heartbroken after queuing up for Coldplay tickets, only to watch them sell out in minutes. But don’t sweat it—Chris Martin and co. have added a third show to keep up with India’s insatiable demand.

And if you’re desperate enough, you can snag a resale ticket—if you’re willing to shell out five times the original price.

Not to be outdone, Punjabi superstar Diljit Dosanjh just sold 2.5 lakh tickets at an average of $90 each, while Dua Lipa and Bryan Adams have also left fans scrambling for tickets.

These concert sprees have already pumped Rs 350-400 crore into the economy—nearly 40% of what some fast-food chains make in a whole quarter.

Heartbreakingly, Millennials and Gen Z aren’t looking to splurge on burgers and sodas anymore, instead their wallets are going toward experiences, fast fashion, luxe beauty products, and premium gadgets.

But don’t think the food delivery giants are sweating it—Zomato and Swiggy are still riding high, with Zomato named CLSA’s top pick.

Zomato’s food delivery biz has seen over 25% growth quarter after quarter, miles ahead of the sluggish single-digit gains from fast-food chains. And with Paytm’s ticketing business now under its belt, Zomato is ready to serve up a full menu of experiences—from booking restaurants to snapping up concert tickets—all in one app.

CLSA is bullish on Zomato, bumping its target price up to Rs 353 per share, a 21.5% upside from the previous Rs 290.5.

And it’s not just Zomato cashing in—MakeMyTrip and Nykaa are thriving too.

Beauty sales on Nykaa skyrocketed 28%, airline bookings on MMYT soared 29%, and Trent’s fashion sales surged 22% in Q1 FY2025.

Hence, the future of spending in India?

Well, it’s all about the experience!

The Last Bit, In an era where instant gratification reigns supreme, Millennials and Gen Z are rewriting the rules of retail.

These digital natives are turning to e-commerce platforms as their go-to for everything—from groceries to high-end fashion—with a click of a button.

These tech-savvy cohorts prefer to shop from the comfort of their homes, often influenced by their favourite social media personalities. According to eMarketer, global e-commerce sales reached a whopping $5.2 trillion in 2021, and these two generations are largely responsible for that surge.

Likewise, Social media has become the new storefront, where Instagram influencers and TikTok stars serve as virtual sales reps, guiding Gen Z and Millennials toward their next “must-have” product. With 67% of Millennials and 63% of Gen Z opting for online shopping, traditional retail is scrambling to keep up.

Unlike their predecessors, Millennials and Gen Z are not just consumers—they’re conscious consumers. For them, buying something isn’t just about fulfilling a need; it’s about aligning with their values. Whether it’s eco-friendly packaging, fair trade certifications, or supporting social causes, these generations are willing to put their money where their mouth is.

In fact, 73% of Gen Z and 62% of Millennials are willing to pay more for sustainable products, according to a study by First Insight.

Hence, this shift in values has ignited a global push for ethical consumption, forcing brands to rethink their strategies giving way to the rise of sustainable fashion to eco-friendly beauty products.

Businesses are waking up to the reality that if they don’t go green, they might not survive in this new age of consumer activism and the credit for that goes to Millennials and Gen Z!