Shopping on Temu can feel like playing an arcade game. Instead of using a joystick-controlled claw to grab a toy, visitors to the online marketplace maneuver their computer mouses or cellphone screens to browse colorful gadgets, accessories and trinkets with prices that look too good to refuse.

A pop-up spinning wheel offers the chance to win a coupon. Rotating captions warn that a less than $2 camouflage print balaclava and a $1.23 skeleton hand back scratcher are “Almost sold out.” A flame symbol indicates a $9.69 plush cat print hoodie is selling fast. A timed-down selection of discounted items adds to the sense of urgency.

Welcome to the new online world of impulse buying, a place of guilty pleasures where the selection is vast, every day is Cyber Monday, and an instant dopamine hit that will have faded by the time your package arrives is always just a click away.

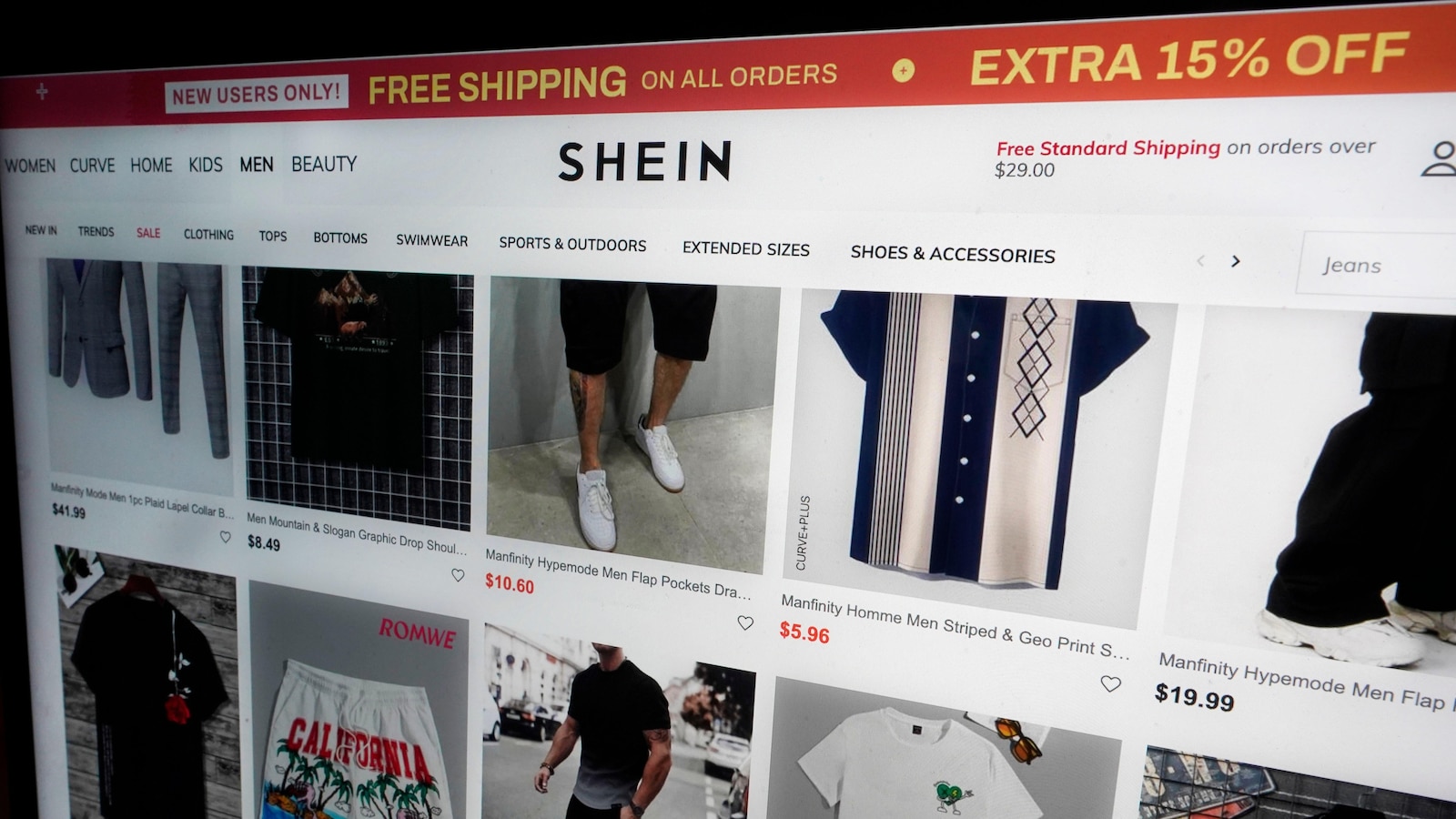

By all accounts, we’re living in an accelerating age for consumerism, one that Temu, which is owned by the Chinese e-commerce company PDD Holdings, and Shein, its fierce rival, supercharged with social media savvy and an interminable assortment of cheap goods, most shipped directly from merchants in China based on real-time demand.

The business models of the two platforms, coupled with avalanches of digital or influencer advertising, have enabled them to give Western retailers a run for their money this holiday shopping season.

Software company Salesforce said it expects roughly one in five online purchases in the U.S., the United Kingdom, Australia and Canada to be made through four online marketplaces based or founded in Asia: Shein, Temu, TikTok Shop – the e-commerce arm of video-sharing platform TikTok – and AliExpress.

Analysts with Salesforce said they are expected to pull in roughly $160 billion in global sales outside of China. Most of the sales will go to Temu and Shein, a privately held company which is thought to lead the worldwide fast fashion market in revenue.

Lisa Xiaoli Neville, a nonprofit manager who lives in Los Angeles, is sold on Shein. The bedroom of her home is stocked with jeans, shoes, press-on nails and other items from the ultra-fast fashion retailer, all of which she amassed after getting on the platform to purchase a $2 pair of earrings she saw in a Facebook ad.

Neville, 46, estimates she spends at least $75 a month on products from Shein. A $2 eggshell opener, a portable apple peeler and an apple corer – both costing less than $5 – are among the quirky, single-use kitchen tools taking up drawer space. She acknowledges she doesn’t need them because she “doesn’t even cook like that.” Plus, she’s allergic to apples.

“I won’t eat apples. It will kill me,” Neville said, laughing. “But I still want the coring thing.”

Shein, now based in Singapore, uses some of the same web design features as Temu’s, such as pop-up coupons and ads, to persuade shoppers to keep clicking, but it appears a bit more restrained in its approach.

Shein primarily targets young women through partnerships with social media influencers. Searching the company’s name on video platforms turns up creators promoting Shein’s Black Friday sales event and displaying the dozens of of trendy clothes and accessories they got for comparatively little money.

But the Shein-focused content also includes videos of TikTokers saying they’re embarrassed to admit they shopped there and critics lashing out at fans for not taking into account the environmental harms or potential labor abuses associated with products that are churned out and shipped worldwide at a speedy pace.

Neville has already picked out holiday gifts for family and friends from the site. Most of the products in her online cart cost under $10, including graphic T-shirts she intends to buy for her son and jeans and loafers for her daughter. All told, she plans to spend about $200 on gifts, significantly less than $500 she used to shell out at other stores in prior years.

“The visuals just make you want to spend more money,” she said, referring to the clothes on Shein’s site. “They’re very cheap and everything is just so cute.”

Unlike Shein, Temu’s appeal cuts across age groups and gender. The platform is the world’s second most-visited online shopping site, software company Similarweb reported in September. Customers go there looking for practical items like doormats and silly products like a whiskey flask shaped like a vintage cellphone from the 1990s.

Temu advertised Black Friday bargains for some items at upwards of 70% off the recommended retail price. Making a purchase can quickly result in receiving dozens of emails offering free giveaways. The caveat: customers have to buy more products.

Ellen Flowers, 36, a lifestyle blogger who lives in Dallas, recently decided to pair a $3,500 dining table with $25 dining chairs from Temu to save money. She’s also purchased clothes from Temu. The quality or fit wasn’t always always great, so Flowers donated some unwanted pieces to thrift stores to avoid paying return shipping fees that would cost almost as much as the clothes.

Flowers planned to buy stocking stuffers on Temu as well as baubles for an ornament-swapping party in early December. She also wanted to buy necklaces and bracelets for an activity at her 5-year-old niece’s upcoming birthday party.

“I love buying my nieces presents,” Flowers says. “Since they’re young, they don’t need the Louis Vuitton handbag. I can give them a cute handbag from Temu. Then they’ll lose interest in a month and I’ll buy them another one.”

Despite their rise, Temu and Shein have proven particularly ripe for pushback. Last year, a coalition of unnamed brands and organizations launched a campaign to oppose Shein in Washington. U.S. lawmakers also have raised the possibility that Temu is allowing goods made with forced labor to enter the country.

More recently, the Biden administration put forward rules that would crack down on a trade rule known as the de minimis exception, which has allowed a lot of cheap products to come into the U.S. duty-free. President-elect Donald Trump is expected to slap high tariffs on goods from China, a move that would likely raise prices and across the retail world.

Both Shein and Temu have set up warehouses in the U.S. to speed up delivery times and help them better compete with Amazon, which is trying to erode their price advantage through a new storefront that also ships products directly from China.

Meanwhile, Temu is onboarding Chinese merchants to store inventory in the U.S., a move that would allow the company to not be as exposed to changes around the de minimus trade rule, said Juozas Kaziukenas, founder of e-commerce intelligence firm Marketplace Pulse.

The change comes as both Shein and Temu are attempting to expand beyond the bargain-hungry shoppers who popularized their platforms. Temu is allowing sellers to ship products to customers from local U.S. warehouses and says the move will allow it to sell larger items like furniture as it expands its selection of big-ticket items.

Meanwhile, American children’s clothing retailer The Children’s Place signed a deal last month to distribute its products through Shein’s platform. Last year, Shein went into business with women’s fashion retailer Forever 21. It has been working to recruit other brands and reportedly has hopes of getting listed on the London Stock Exchange.